A Beginner’s Guide to Investing in Cryptocurrencies

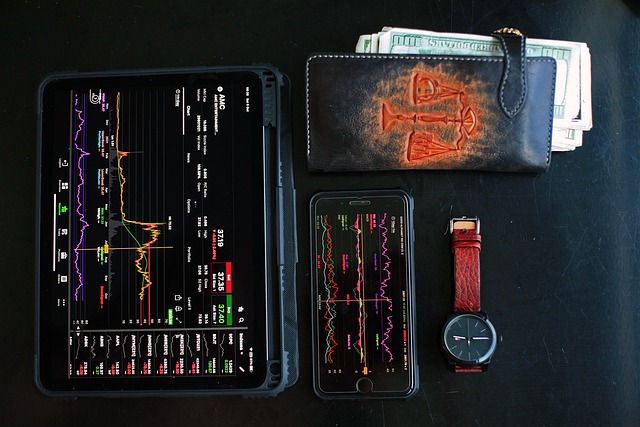

Cryptocurrencies have become increasingly popular over the past decade, with many people looking to invest their money in these digital assets. However, investing in cryptocurrencies can be a daunting task, especially for beginners. In this article, we will provide a comprehensive guide on how to get started with investing in cryptocurrencies.

First and foremost, it’s essential to understand that investing in cryptocurrencies carries a high level of risk. The cryptocurrency market is highly volatile, and prices can fluctuate rapidly. This means that the value of your investment can drop just as quickly as it rises.

How to Choose the Right Cryptocurrency for Long-term Investment is an excellent resource to help you make informed decisions about which cryptocurrencies to invest in. By considering factors such as market capitalization, trading volume, and development teams, you can increase your chances of success.

Top Factors to Consider Before Buying Any Cryptocurrency provides a detailed analysis of the key factors to consider before making an investment. From market trends and competition to regulatory environments and security measures, understanding these factors is crucial for making informed decisions.

Before you start investing in cryptocurrencies, it’s essential to educate yourself on the subject. Here are some key points to keep in mind:

Step 1: Understand the Basics of Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that use cryptography for security and are decentralized, meaning they are not controlled by any government or financial institution. The most well-known cryptocurrency is Bitcoin, but there are many others, such as Ethereum, Litecoin, and Monero.

Jeremy Camp – Getting Started (Music Video) – YouTube may not be directly related to cryptocurrencies, but it can provide a good analogy for understanding the concept of getting started with something new. Just as Jeremy Camp’s music video requires patience and dedication to master, investing in cryptocurrencies requires time and effort to learn.

Step 2: Choose a Reliable Exchange

A reliable exchange is crucial for buying and selling cryptocurrencies. Look for an exchange that offers a user-friendly interface, competitive fees, and robust security measures.

Getting Started – Let’s Encrypt provides valuable insights into the importance of security in online transactions. Just as Let’s Encrypt helps protect websites from hacking, securing your exchange account can help safeguard your cryptocurrency investments.

Step 3: Set a Budget and Risk Tolerance Level

Before investing in cryptocurrencies, it’s essential to set a budget and risk tolerance level. Consider how much you can afford to lose and stick to it. Don’t invest more than you can afford to lose, as this can lead to financial ruin.

Jeremy Camp – Getting Started (Music Video) – YouTube may not be directly related to cryptocurrencies, but it can provide a good analogy for understanding the concept of risk management. Just as Jeremy Camp’s music video requires careful planning and execution, investing in cryptocurrencies demands prudence and caution.

Step 4: Research and Analyze Cryptocurrencies

Researching and analyzing cryptocurrencies is crucial before making an investment. Look for factors such as market trends, competition, and development teams to make informed decisions.

How to Choose the Right Cryptocurrency for Long-term Investment provides valuable insights into how to choose the right cryptocurrency for long-term investment. By considering factors such as market capitalization, trading volume, and development teams, you can increase your chances of success.

Step 5: Diversify Your Portfolio

Diversifying your portfolio is essential for minimizing risk and maximizing returns. Spread your investments across different cryptocurrencies to reduce your exposure to any one particular asset.

Top Factors to Consider Before Buying Any Cryptocurrency provides a detailed analysis of the key factors to consider before making an investment. From market trends and competition to regulatory environments and security measures, understanding these factors is crucial for making informed decisions.

Conclusion

Investing in cryptocurrencies can be a daunting task, but by following the steps outlined in this article, you can increase your chances of success. Remember to educate yourself on the subject, choose a reliable exchange, set a budget and risk tolerance level, research and analyze cryptocurrencies, and diversify your portfolio. By taking these steps, you can navigate the world of cryptocurrencies with confidence and potentially reap the rewards.